carried interest tax loophole

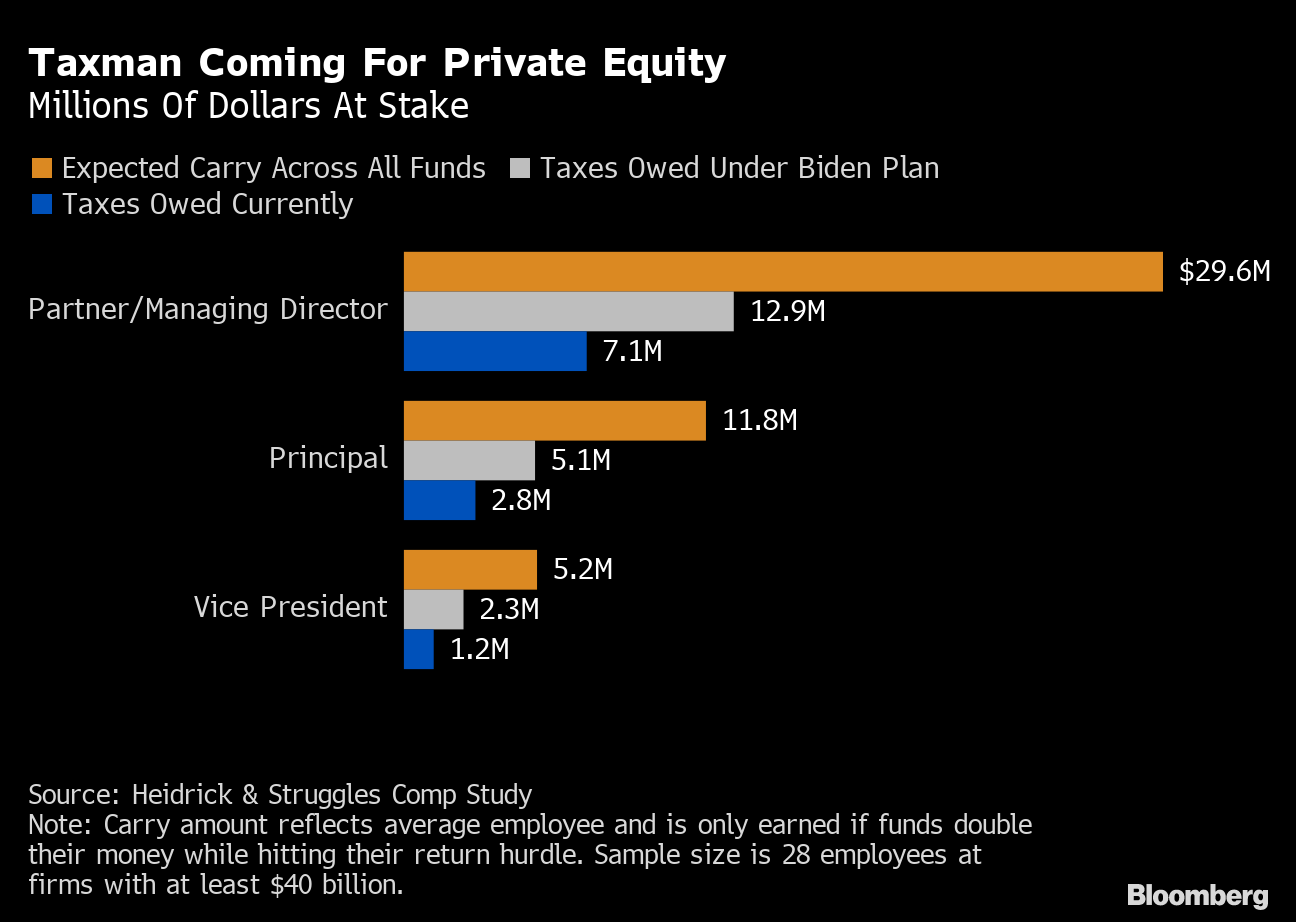

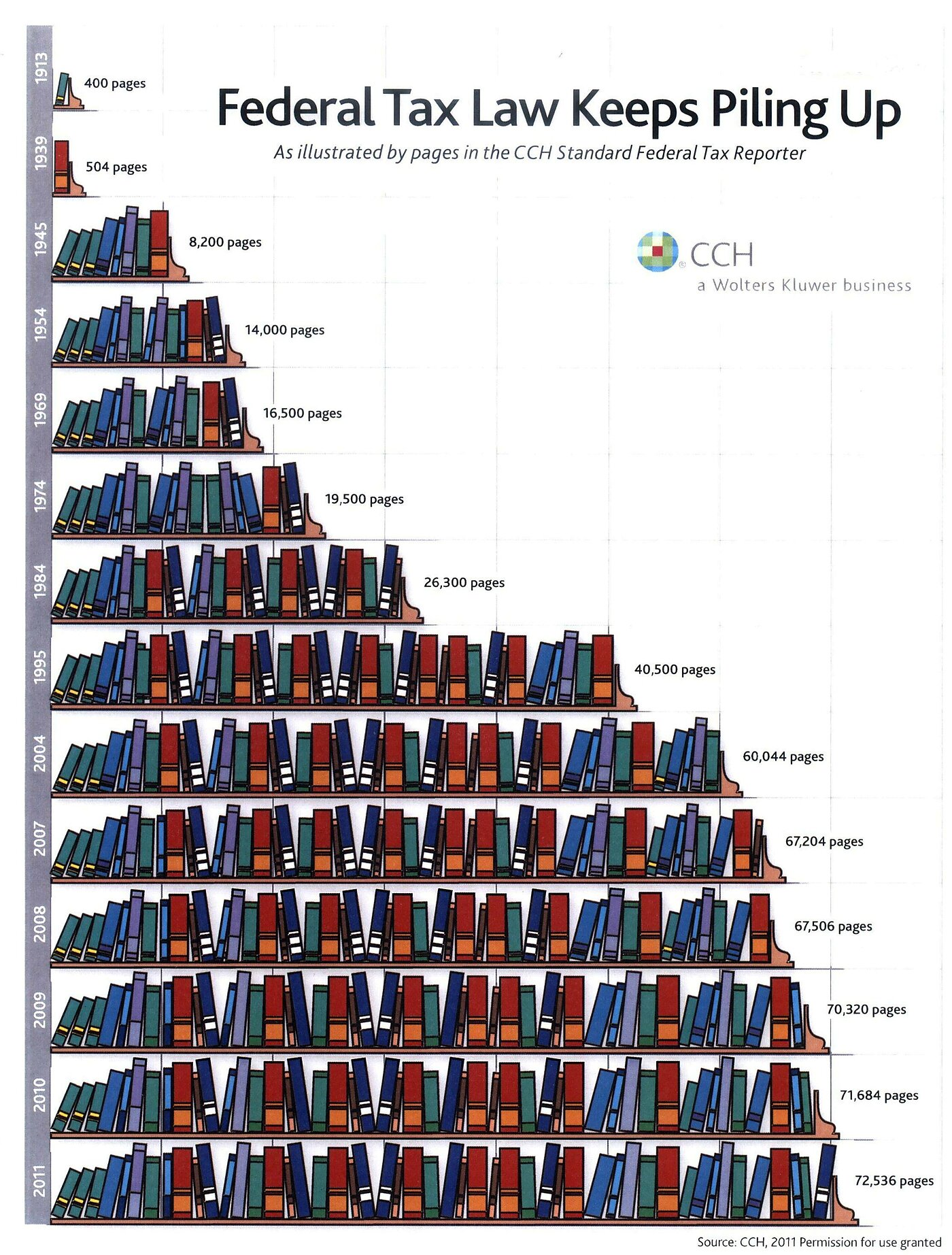

T he person most responsible for inspiring the movement against the carried-interest tax loophole is Victor Fleischer a tax-law professor at the University of San Diego School of Law. Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax rate on income received as compensation rather than the ordinary income tax rates of up to 37 percent that.

Debunking Fiscal Myths There Is No Loophole For Carried Interest

Bloomberg Mnuchin Hints at Keeping Carried Interest Tax Break for Some Aug.

. 28 2017 Read. Another reason that carried interest is at the center of debates is because of how its taxed. July 15 2016.

Try as one might it is impossible to find a special tax rule that allows Hedge Funds and Hedge Fund managers to take advantage of the US tax code in a way that no other investor can. 1639 would treat the grant of carried interest to a general. Carried interest has long been the center of debate in the US with many politicians arguing that it is a loophole that allows private.

Because its not classified as ordinary income general partners have to pay far less tax than they normally would. Senate Finance Committee Chairman Ron Wyden D-Ore and Sen. Some view this tax preference as an unfair market-distorting loophole.

Carried Interest Loophole Bill. For 100 years since federal taxation of. This allows wealthy private equity real estate and hedge fund managers to claim the fees they receive for their services as capital gains which are taxed at a rate of just 238 percent instead of the top marginal income tax rate of 37 percent.

This creates a controversy that carried interest is a tax loophole. The carried interest loophole is an absurd mischaracterization of income that allows about 5000 of the richest people in America to divide conservatively 18 billion a year between themselves for an average tax break of 300000 a year. Senior White House economic advisor Jared Bernstein pointed to tax lobbyists as the reason the carried interest loophole was not included in a.

Would if enacted tax all or some of carried interest as ordinary income or treat the granting of carried interest as a subsidized loan. 21 2017 Bloomberg Cohn Says Trump Is Committed to Ending Carried Interest Loophole Sept. The White Houses plan to close the carried-interest loophole in current tax law probably wont harm private equity firms according to a research note from Citigroup.

The carried interest loophole allows private equity barons to claim large parts of their compensation for services as. Kevin LamarqueReuters Tue 14 Dec 2021 0610 EST Last modified on Tue 14 Dec. Many politicians want to close the carried interest tax loophole for private equity managers.

The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes. What is the Carried Interest Loophole. Facing a 15BB deficit and an upcoming budget expected to be laden with additional cuts to services and jobs I joined fellow lawmakers and advocates today to introduce Proposed Bill 6973 which would close the carried interest tax loophole which would generate more than 520 million for the state.

Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax rate on income received as compensation rather than the ordinary income tax rates of up to 37 percent that. The only problem is no such loophole exists. In summary the Carried Interest Fairness Act of 2021 would seek to tax all carried interest allocations at ordinary rates regardless of the character of income determined at the partnership level and only for taxpayers with taxable income exceeding 400000.

Carried interest is often the subject of political controversy because many believe it represents income that receives preferential treatment under the US. Anthony Parent 2017-09-05 There is actually no such thing as the Carried-Interest Loophole. The loophole exacerbates income and.

The carried interest loophole is unfair to everyone except the fabulously rich who benefit from it Photograph. The Treasury Department has calculated that closing the carried interest loophole would generate around 18 billion a year -- not exactly a windfall for. The best summation comes from the Patriotic Millionaires who said.

Sheldon Whitehouse D-RI have introduced legislation to close the carried interest loophole ending a tax dodge for wealthy private. The proposed Ending the Carried Interest Loophole Act S. Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation.

Others argue that it is consistent with the tax treatment of other entrepreneurial income. Carried interest is a rule in the tax code that lets the managers of some types of private investment fundshedge private equity venture. The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes.

One of the most extreme examples of tax privilege is the so-called carried interest loophole. Tax CodePoliticians from both parties often view carried interest as a tax loophole.

Treasury To Issue Carried Interest Regulations Closing Perceived S Corporation Loophole Butler Snow

Carried Interest In Private Equity Calculations Top Examples Accounting

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

Carried Interest In Private Equity Definition Examples Accounting Youtube

The Commander In Chief Has Again Voiced His Displeasure With The Carried Interest Tax Provision Which Allows Many Pe Inv Philip Iv Of France White House Tours

How The Carried Interest Loophole Makes The Super Rich Super Richer Billmoyers Com

Carried Interest Tax Private Equity Billionaires Angry Over Closing Loophole Bloomberg

Loopholes 101 Carried Interest Loophole Patriotic Millionaires University

You Want To Know A Really Dirty Secret Here S Why Democrats Are Protecting Private Equity S Carried Interest Loophole

Loopholes 101 Carried Interest Loophole Patriotic Millionaires University

Beyond The Carried Interest Tax Loophole Occasional Links Commentary

Labour Announces Plans To Tax Carried Interest As Income Lawrence Parkin

Ending Carried Interest Benefit Is One Tax Policy Trump And Clinton Agree On

Debunking Fiscal Myths There Is No Loophole For Carried Interest Cato At Liberty Blog

Carried Interest Calculation Tax Loophole Understanding Pe Vc Youtube

Beyond The Carried Interest Tax Loophole Occasional Links Commentary